Retirement, often envisioned as a period of relaxation, leisure, and the pursuit of personal passions, can quickly turn into a time of considerable stress and hardship without adequate preparation. Many individuals approach their working years with the implicit assumption that retirement will naturally fall into place, but the harsh reality is that a comfortable and secure retirement requires diligent planning and consistent effort. The alarming truth is that a significant portion of the population is facing the prospect of retirement with insufficient savings, putting their financial well-being and overall quality of life at risk. This blog post will delve into the potential consequences of neglecting retirement planning, painting a clear picture of what can happen if you don’t prepare for this crucial stage of life. Understanding these potential pitfalls can serve as a powerful motivator to take proactive steps towards securing a brighter future.

Financial Insecurity: A Life of Constant Worry

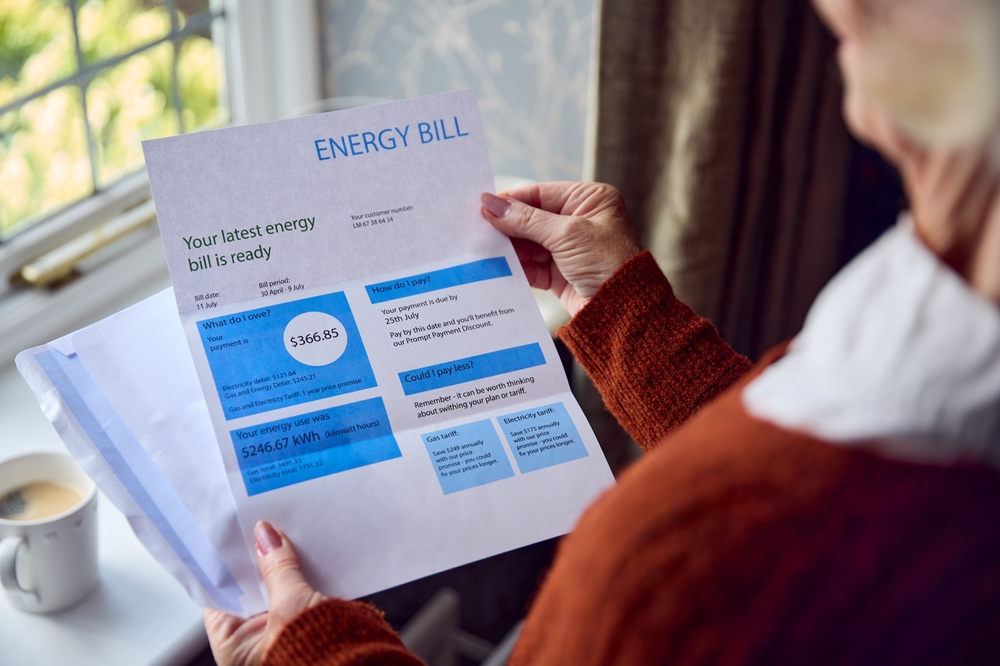

One of the most immediate and significant consequences of inadequate retirement planning is financial insecurity. Imagine a life where every expense, from groceries and utility bills to unexpected medical costs, becomes a source of anxiety. This is the unfortunate reality for many who enter retirement without sufficient savings. A Nest Egg report in 2023 revealed that 45% of Americans have less than $10,000 saved for retirement, a stark indicator of the widespread unpreparedness. Without a steady stream of income from employment, retirees are forced to rely solely on their savings, which can deplete rapidly, especially with the increasing cost of living. Unexpected expenses, such as home repairs, medical bills, or even assisting family members, can quickly drain limited resources, plunging retirees into a state of constant financial worry. This chronic stress can have a detrimental impact on both physical and mental health, leading to anxiety, depression, and even exacerbating existing health conditions. The emotional toll of constantly worrying about money can be devastating, robbing individuals of the peace of mind and enjoyment that retirement should offer.

Dependence on Others: A Blow to Independence

For those who haven’t adequately prepared for retirement, the harsh reality may involve relying on family members for financial support. While family can be a valuable source of support, dependence can strain relationships, create resentment, and erode the retiree’s sense of independence. No one wants to feel like a burden, and the inability to provide for oneself can be a significant blow to self-esteem and dignity. This situation can also create a ripple effect of financial strain within the family, particularly if the supporting family members are themselves facing financial challenges. The AARP reports that over 20% of adults aged 50 and older provide financial support to their adult children, a situation that can become even more complex when the parents themselves are struggling financially. This interdependence can create a cycle of financial insecurity, affecting multiple generations. The loss of autonomy associated with financial dependence can be particularly difficult for individuals accustomed to self-reliance, and can significantly diminish the quality of life during retirement.

Working Longer Than Expected: A Physical and Emotional Strain

Many individuals envision retirement as a time to finally step away from the workforce and enjoy well-deserved rest and leisure. However, without adequate retirement savings, this dream can become unattainable. Individuals may be forced to continue working well into their later years, often past the traditional retirement age, simply to make ends meet. Working longer can take a significant toll on both physical and emotional well-being. Physical limitations, age-related health issues, and decreased energy levels can make continued employment challenging and even painful. Furthermore, the emotional burden of working while peers are enjoying retirement can lead to feelings of resentment, frustration, and social isolation. A 2020 study by the Employee Benefit Research Institute found that 25% of workers expect to retire later than planned, largely due to financial concerns. This delayed retirement not only impacts individual well-being but also has broader societal implications, as it can affect workforce demographics and potentially limit opportunities for younger generations. Link to relevant study on delayed retirement

Sacrificing Quality of Life: Missing Out on Golden Years

Retirement should be a time to pursue hobbies, travel, spend time with loved ones, and finally enjoy the fruits of one’s labor. However, without sufficient financial resources, these aspirations can become distant dreams. Limited finances can severely restrict the ability to engage in leisure activities, travel, or even maintain social connections. Imagine having to forgo that long-dreamed-of trip, being unable to afford hobbies, or missing out on social gatherings due to cost constraints. This diminished quality of life can lead to feelings of isolation, regret, and dissatisfaction, robbing individuals of the joy and fulfillment that retirement should offer. A survey conducted by Transamerica Center for Retirement Studies found that 66% of retirees cited travel as a top retirement goal, but without adequate savings, such goals often remain out of reach. Link to Transamerica Center for Retirement Studies This can create a profound sense of disappointment and a feeling of having missed out on the “golden years.”

Increased Risk of Healthcare Hardship: A Looming Threat

Healthcare costs are a significant concern for everyone, but they become particularly daunting for retirees living on fixed incomes. As we age, the likelihood of needing medical care increases, and the costs associated with healthcare can be substantial. Without adequate health insurance and financial reserves, retirees face the very real risk of foregoing necessary medical treatment due to cost constraints. This can lead to a decline in health, increased suffering, and even premature death. A 2021 report by Fidelity estimated that a couple retiring in 2021 would need approximately $300,000 to cover healthcare expenses in retirement, a figure that is constantly rising. Link to Fidelity’s retiree healthcare cost estimate This financial burden can quickly overwhelm retirees with limited resources, leading to debt, financial instability, and significant emotional distress. Furthermore, the stress of managing healthcare expenses can exacerbate existing health problems, creating a vicious cycle of declining health and financial hardship.

Conclusion

The potential consequences of not preparing for retirement paint a bleak picture, filled with financial insecurity, dependence, and a diminished quality of life. The examples and statistics throughout this post underscore the urgent need for proactive retirement planning. Starting early, even with small contributions, can make a significant difference in the long run. Seeking professional financial advice can provide personalized guidance and help individuals develop a tailored retirement plan that aligns with their specific goals and circumstances. Don’t let the fear of the unknown paralyze you; take action today. By taking control of your financial future, you can ensure a retirement filled with peace of mind, financial security, and the opportunity to enjoy the fruits of your labor. The peace of mind that comes with knowing you have adequately prepared for retirement is invaluable. It allows you to approach this stage of life with confidence, knowing that you have the resources to enjoy the freedom and opportunities it presents. Don’t wait; start planning today.